Peer to peer trading of crowdfunding shares in real-time!

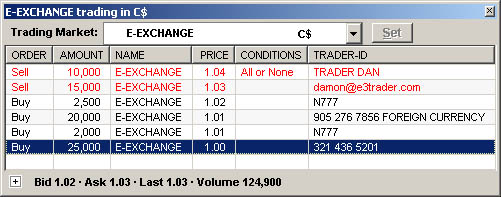

Crowdfunding for shares creates a new use for eCrowdex, our real-time 24×7 exchange software ideal for trading shares of public companies and crowdfunding start-ups.

On eCrowdex, investors trade peer to peer directly with each other or through a broker on an integrated exchange that combines the broker, exchange & clearinghouse functions on one platform with same day (T+0) settlement.

Crowdfunding for products, services and charities occurs 24 hours a day. We anticipate that crowdfunding for shares will operate 24×7 in the United States just as it does in Great Britain right now.

Why we have real-time 24-hour trading

Retail investors (non-corporate) have time to trade stocks during the evenings and weekends but the stock markets are closed. The success of online gambling and crowdfunding for products and charities suggests that stock trading would increase if retail investors had access to 24×7 trading.

Small investor participation in the stock market is declining. Fewer small investors now have daily access to a broker and higher fees force most small investors to trade online.

Brokers rarely solicit orders from online investors during regular 9:30am to 4:00pm trading hours.

eCrowdex solves these problems by providing a peer to peer 24-hour market where investors can have direct contact with each other at all hours including nights and weekends when they have time to trade.

Crowdfunding does what the brokerage industry doesn’t

Crowdfunding has two features that are not compatible with current brokerage practice:

- many small transactions (crowdfunding for the TikTok watch raised over $900,000 from over 13,000 participants)

- 24 x 7 access for fund raising.

Crowdfunding for shares caters to small investors while the brokerage industry discourages small investor participation. For example, some online fees include a $29 minimum transaction fee for stocks trading under $2 for small investor related accounts with assets of less than $50,000. Large accounts pay just a $9 transaction fee for stocks trading over $2.

The average TikTok purchase was about $70 and TikTok paid Kickstarter fees of about $6 per $70 transaction. A $70 stock trade cannot support a $29 minimum fee!

eCrowdex makes crowdfunding for shares possible by making both small transactions and access to 24×7 trading economical. In addition, eCrowdex software provides an economic aftermarket for trading small transactions with same day (T+0) settlement.

We anticipate that a small investor who frequently trades only a few stocks will have an aftermarket transaction cost of between $3 & $5. A $2 fee for small crowdfunding transactions is possible. Initial offerings and private placements of crowdfunding shares and other securities would have fees similar to the 9% that crowdfunding portals charge.

Need to know more…

Our eCrowdex trading software has completed beta testing. For information about how we can advance direct investor to investor trading of crowdfunding shares & other securities, contact:

Russell Martel, 540-464-5333

[email protected]